CS Njuguna Ndung’u-National Treasury imposes a new tax on online forex brokers.

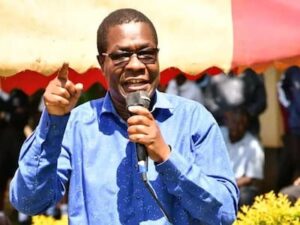

National Treasury Cabinet Secretary Prof. Njuguna Ndung'u, CBS

The Treasury’s implementation of a regulatory fee on online forex brokers has given the Capital Market Authority (CMA) a new revenue stream.

Treasury Cabinet Secretary Njuguna Ndung’u announced modifications to the rules governing online forex trading, including the requirement that brokers pay an annual fee to the regulator.

“The following new rule is inserted immediately after regulation 25 to amend the Capital Markets (Online Forex Exchange Trading) Regulations, 2017, from now on referred to as the “principal Regulations,” Prof. Ndung’u stated.

“An online forex broker shall pay an annual fee, at the rate specified in the Third Schedule, to the Authority based on the gross trading revenue for that year, which shall include the commissions and rebates from third-party related service providers,” the speaker stated.

The new rules state that online forex brokers, dealing or non-dealing, would pay the CMA an annual charge of three percent of their gross revenue, which includes commissions and rebates.

By establishing the bid and ask prices and waiting for a trader who wants to take advantage of these predetermined terms, a dealing forex broker, also known as a market maker, assumes the opposite side of a client’s trades.

Dealing desk brokers profit from buying at cheaper prices and selling at higher prices, as well as from price spreads between the ask and bid prices.

The fee on online forex brokers after the CMA’s improved client protection for currency trading.

The capital markets regulator has put together a working group consisting of representatives from the regulated Forex brokerage industry and other interested parties to develop rules that would further protect customers.

For instance, CMA is attempting to ensure that licensed forex brokers carry out a comprehensive investor education program and offer the required disclosures.

The assessment aims to reduce the losses and hazards connected to investing in contracts for differences, or CFDs.

transactions for transactions involving buyers and sellers that require a buyer to reimburse a seller for the difference between an asset’s current value and its value at the time of the contract, with the asset portfolio containing currencies, are known as CFDs.

The investing public’s ongoing interest in forex trading coincides with CMA’s decision to strengthen the protection of forex dealers.

The CEO of CMA, Wycliffe Shamiah, stated, “To foster and deepen growth in the online forex trading industry, CMA has facilitated the establishment of a Technical Working Group comprising of the licensed online foreign trading brokers as well as other stakeholders, including peer regulators to assess the state of the market and propose recommendations to mitigate the challenges faced by investors, traders, and licensed players”

The 2017 Capital Markets (Online Forex Trading) Regulations currently serve as guidelines for online Forex trading.

It is legal for brokers and money managers to inquire about their client’s financial status and investing objectives.